How to Become an Independent Mortgage Broker in 2023: 7 Steps to Success

Imagine stepping into a world of financial independence, where you have the flexibility to work from any location, access to countless lenders, fewer meetings, and the ability to earn a significant amount more per loan with much lower rates. Welcome to the life of an independent mortgage broker in 2023! This comprehensive guide will cover the benefits of leaving captive banks for the independent broker world.

Short Summary

Making the switch from a captive bank loan officer to becoming an independent mortgage broker will enable you to offer rates that are typically half a point to a point lower while making thousands more per loan than what a typcial mortgage bank would pay. You will also have access to better technology, programs, and support.

The Advantages of Being an Independent Mortgage Broker

The life of an independent mortgage broker is often marked by flexibility and control. Unlike loan officers who are limited to the loan products of one bank, mortgage brokers have the freedom to work with multiple lenders, providing a broader range of options to their clients. More loan products mean you can close more deals the big banks often deny. This flexibility extends beyond the lending institutions they work with; independent mortgage brokers can also choose their work environment, opting to run their business from a physical office or remotely.

The advantages of being an independent mortgage broker don’t end with flexibility. The earning potential in this profession is substantial. According to the Bureau of Labor Statistics, the mean annual salary for mortgage brokers in the United States is $70,000, but this can vary widely depending on location, experience, and client volume. Plus, as the liaison between borrowers and lenders, mortgage brokers can receive commissions and fees from either party. If the lender pays the broker a commission that is called lender-paid commission. This is usually set at the same percentage with all lenders to comply with Fair Lending laws. Lender Paid Commission (LPC) is usually around 200 basis points. Borrower-paid commission (BPC) is paid by the borrower to the loan officer in the form of an origination fee. It is typically lower than lender-paid commission and usually reduces the rate for the borrower by .25-.375. This pricing flexibility is beneficial to the borrower and allows brokers to be much more competitive than captive retail lenders. Shopping multiple lenders and having the option to go LPC or BPC allows an LO to maintain credibility with their referral partners, realtors, and clients. No more begging management for price exceptions to win a loan or a realtor.

Choosing the right mortgage channel is a big decision. See how being an independent mortgage broker stacks up against the big banks in a side-by-side comparison here.

Flexibility in Work Environment

The flexibility in the work environment that independent mortgage brokers enjoy is unparalleled. Whether in a bustling office or the comfort of their home office, brokers can set up shop wherever they feel most productive. This flexibility can be a major advantage, particularly in the current digital age where remote work is becoming the standard.

Moreover, as a mortgage broker, time management becomes easier. The brokerage company typically takes care of all the compliance, state approvals, lender approvals, & payroll so the LO can sell. Meetings are rare, so say goodbye to the days of countless meetings that should have been an email. The only training required is annual CE requirements and non-traditional loan program training like the All In One loan. You will save hours every week with fewer meetings and training and you can put that time into prospecting, your family, or recreation.

Access to Multiple Lenders

One of the most significant advantages of being an independent mortgage broker is the access to multiple lenders. This wealth of connections allows them to compare and offer the most efficient and cost-effective loan options for their clients. This level of variety is simply not possible for loan officers who are limited to the products of their employing institution. Mortgage Loan Originators can compare lenders based on programs, guideline flexibility, turn-times, customer service, rates, and fees. It also gives mortgage brokers access to a lot more non-traditional or Non-QM programs and rates on these programs that a borrower will actually be willing

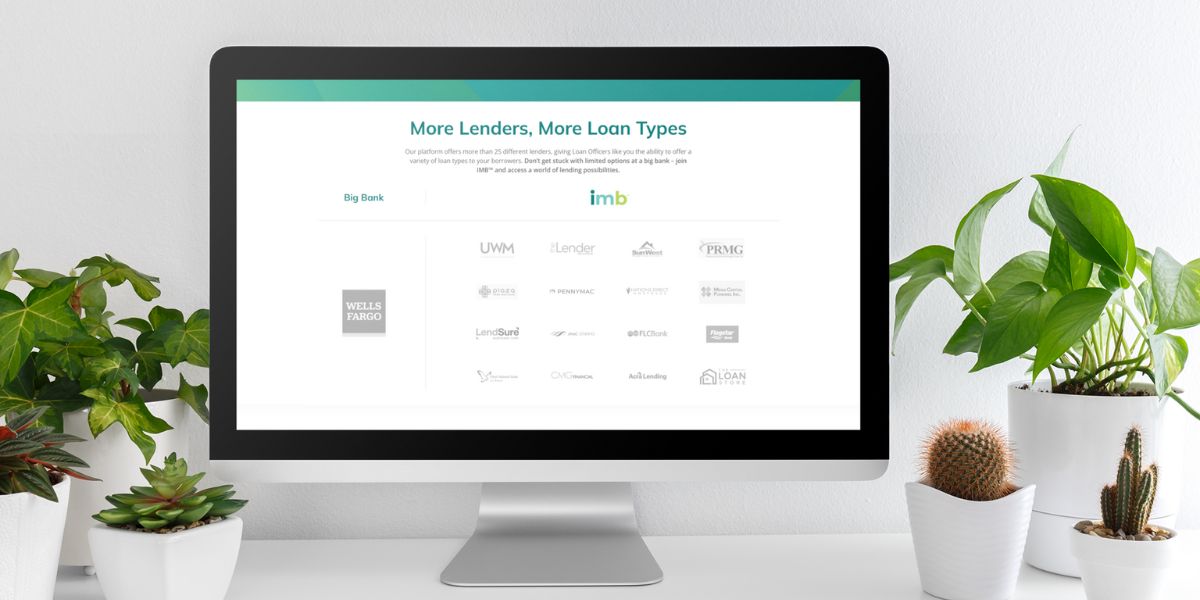

There are roughly 70 wholesalers nationwide. Most brokers work with 20-30 lenders. Companies like IMB™ have worked with 50 of them and top-graded them down to 40 based on consistency of service & pricing.

Having access to this diverse pool of lenders not only benefits the clients but also the brokers themselves. It enables them to navigate the financial landscape more effectively, equipping them with the knowledge and expertise to find the ideal mortgage options for their clients. With access to multiple lenders, mortgage brokers can truly serve as advocates for their clients, ensuring that they receive the best possible terms and rates.

Earning Potential

The earning potential for independent mortgage brokers can be substantial. Income is largely dependent on factors such as location, experience, and client volume, giving them the control to increase their earnings based on these variables. For instance, a broker in a bustling metropolis may have a higher earning potential than one in a less populated area, due to a higher volume of potential clients.

Furthermore, brokers earn a fee upon loan closure, typically ranging from 1% to 2% of the total loan amount. This, combined with their base salary, can lead to significant earnings. In fact, the mean annual salary of mortgage brokers in the United States is estimated to be $70,000.

Ryan Davis, a founder and producing loan officer at IMB™, says, “Independent mortgage brokers are typically making $3-5K more per deal and half a point lower in rate compared to captive retail lenders. That’s significant but well-merited. Why give that away to banking giants when you are directly serving your community?”

This promising earning potential makes becoming an independent mortgage broker an attractive career choice.

Steps to Becoming an Independent Mortgage Broker

Embarking on the journey to become an independent mortgage broker requires dedication and diligent preparation. It involves a series of steps, starting with obtaining the necessary education and training, fulfilling licensing requirements, and finally, establishing your own brokerage.

Being a mortgage broker is not just about crunching numbers. The role is multi-faceted, involving building professional relationships with lenders, understanding client needs, and ensuring loans comply with existing regulations and laws. It’s a role that demands an understanding of the financial landscape, and the ability to navigate it effectively.

Education and Training

The first step to becoming a mortgage broker, especially an independent mortgage broker, is acquiring the necessary education and training. At the very least, a high school diploma or a General Education Development (GED) is required. Some may opt to further their education by pursuing a degree in business administration, finance, or accounting, although this is not a prerequisite.

In addition to these academic qualifications, prospective brokers are required to complete a 20-hour pre-licensure program approved by the National Mortgage License System (NMLS). This program provides an overview of federal and state mortgage laws, broker ethics, and financial regulations, serving as an essential foundation for the profession.

It’s also recommended to gain some practical experience, such as working in a well-known mortgage company, to get a first-hand understanding of the industry.

Licensing Requirements

Once the education and training requirements are fulfilled, the next step is to obtain a mortgage broker license. This involves passing the NMLS exam, applying for the license, and obtaining a surety bond as required by the respective state. The NMLS exam evaluates comprehension of mortgage practices, as well as state guidelines and regulations. The success rate for the exam is 58% for first-time takers and 47% for second-time takers, indicating the exam’s challenging nature.

It’s also important to note that failing the exam requires a waiting period before retaking. If the NMLS exam is not passed on the first or second attempt, a 30-day waiting period is observed. If failed on the third attempt, a longer 180-day waiting period is required. Hence, thorough preparation is paramount for success.

Establishing Operations

After obtaining the required license, the subsequent phase for any mortgage professional involves setting up the operational structure of their business. This critical step includes choosing an appropriate business structure, such as a sole proprietorship, partnership, or limited liability company (LLC). Each structure offers different benefits and responsibilities, so it’s essential to consider which arrangement best aligns with your business goals and personal liability preferences.

Additionally, securing an Employer Identification Number (EIN) from the IRS is necessary. This unique identifier is not only crucial for tax purposes but also required for activities like opening business bank accounts and setting up payroll systems.

At IMB™, we streamline this process for our Mortgage Loan Originators (MLOs) by providing comprehensive support with business registration and structure selection under a DBA (Doing Business As) that is licensed to IMB™. This service ensures that MLOs can focus more on their core activities of serving clients and less on administrative tasks, maintaining a consistent professional identity while facilitating ease of transition should the need to move arise.

Building Relationships in the Mortgage Industry

If you are making the switch from a captive bank to the independent broker channel, it will feel like you are flying solo. In the mortgage brokerage industry, relationships are key. They play a crucial role in the success of an independent mortgage broker. These relationships span across various stakeholders, including real estate agents, loan officers, and lending institutions.

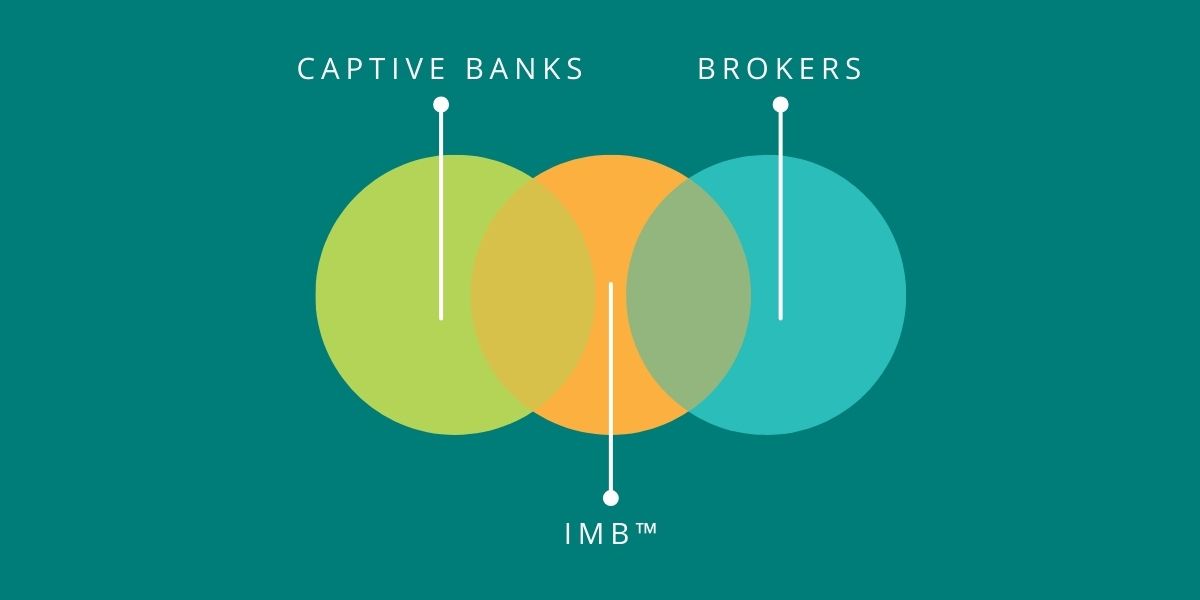

While captive banks provide community, training, best practices, and structure, the independent mortgage broker will very much be missing these things. The founders of IMB™ experienced this gap and created a company that offers the very best of both worlds.

Effective networking strategies are still essential in building relationships and business. These strategies include attending industry events, engaging with other professionals, and establishing a solid online presence. Regular communication, providing helpful advice and resources, and staying informed of industry trends and regulations are also important in maintaining these relationships.

Companies like IMB™ solve this problem by providing a strong sense of community, support, training, and more (all the goods from big banks) with all of the best of the mortgage broker world.

Building relationships is not just about gaining clients. It’s about establishing a presence in the mortgage industry, understanding the landscape, and positioning the business to take advantage of opportunities. It’s about creating a network of professionals who can provide advice, support, and referrals, helping the business to grow and thrive.

Networking Strategies

Networking is an essential tool for building relationships in the mortgage industry. This involves attending industry events and conferences, which provide opportunities to meet potential clients, referral partners, and other industry professionals. Joining committees and participating in events of professional organizations are also effective networking strategies.

Beyond physical networking, the digital space also presents a wealth of opportunities. Social media platforms, for example, can be utilized to connect with potential clients and industry professionals. Engaging with followers, producing compelling content, and utilizing paid advertisements can help establish a robust online presence.

Ultimately, the goal of networking is to build a network that supports the growth and success of the mortgage broker business.

Collaborating with Real Estate Agents

Real estate agents are vital partners in the mortgage industry. They can provide independent mortgage brokers with enhanced opportunities for business expansion, numerous prospective customers, and dependable referral business. As such, fostering a strong relationship with real estate agents is important in the mortgage broker business.

IMB™ MLOs have been employing connection campaigns on LinkedIn with tremendous success. The campaigns run on autopilot to connect MLOs with realtors in their area via organic message drips. Joining IMB™ will give you access to tried and true networking efforts at your fingertips.

To build this relationship, mortgage brokers can also consider attending local real estate events, joining real estate agent networks, and providing incentives for referrals. Furthermore, ensuring timely and accurate information, responding promptly to inquiries, and offering competitive rates can bolster trust and credibility with real estate agents.

By maintaining this relationship, mortgage brokers can ensure a steady stream of potential clients and a fruitful partnership.

Working with Loan Officers and Lending Institutions

Loan officers and lending institutions are also crucial partners in the mortgage industry. Collaborating with them can provide independent mortgage brokers with access to a broader selection of loan products and support with the loan application process. Furthermore, understanding the regulations and procedures utilized by these institutions can aid brokers in finding the most suitable loan products for their clients, as a skilled loan officer would do.

Building relationships with loan officers and lending institutions can be achieved by attending industry events, joining professional organizations, and networking with other professionals in the mortgage industry. Staying informed about industry developments and conducting thorough research on various lenders can ensure brokers have the most recent information and can offer the most accurate advice to their clients.

Marketing Your Independent Mortgage Broker Business

Once the business is established and relationships are built, the next step is to market the independent mortgage broker business. Marketing strategies, such as creating a distinct logo, establishing a website, and leveraging social media, can help to build a strong brand. In addition, utilizing paid advertisements, producing quality content, and verifying the website is correctly indexed can optimize visibility in search engine results.

Beyond online marketing, offline strategies such as networking, cultivating local relationships, and optimizing social media presence can also be effective. Regardless of the strategies used, the goal of marketing is to build trust, stand out from the competition, and engage with potential customers who may not be familiar with the services offered.

Building an Online Presence

In today’s digital age, having an online presence is non-negotiable for any business, and mortgage brokers are no exception. Creating a professional website that is user-friendly and mobile-compatible is the first step. On this platform, brokers can provide pertinent information about their services, showcase testimonials, and even offer resources and tools for potential clients to use.

As an IMB™ MLO, you can access over 60 recommended vendors & resources for accounting, marketing, technology and many other services to get you up and running quickly.

In addition to a website, social media platforms also offer an avenue to connect with potential clients and industry professionals. Platforms such as LinkedIn, Twitter, and Instagram can be utilized to share updates, industry news, and even personal insights about the mortgage industry. By consistently producing engaging content and interacting with followers, brokers can build a robust online presence and attract more clients.

Advertising Strategies

Advertising is another essential aspect of marketing the mortgage broker business. Strategies such as targeted ads, local publications, and direct mail campaigns can be effective in reaching potential clients. Online advertising options, such as Google Ads, can also be utilized to increase website traffic and generate leads.

In addition to these strategies, inbound marketing, which involves creating content to attract potential clients, can also be effective. This could involve creating blog posts, videos, and helpful resources that potential clients might find valuable. By providing value upfront, brokers can build trust with potential clients and position themselves as experts in the industry.

Customer Testimonials and Referrals

Customer testimonials and referrals are incredibly powerful marketing tools. They can foster trust and confidence with prospective customers, demonstrate the advantages of your services, and create an emotional bond with potential clients. Good service leads to satisfied customers, and satisfied customers often lead to more customers.

Strategies to acquire these testimonials and referrals include asking satisfied customers to provide a review or referral, offering incentives for referrals, and leveraging social media platforms to share positive reviews. These testimonials and referrals can be prominently featured on your website, included in your marketing materials, and shared on social media to leverage their full potential.

Maintaining Your Mortgage Broker License

Once you’ve successfully become a licensed independent mortgage broker, the journey doesn’t end there. Maintaining your license is crucial to continue operating as a mortgage broker, and this requires ongoing education, annual license renewal, and staying informed about industry developments.

Upholding a mortgage broker license is more than just a legal requirement. It’s a commitment to staying current in your field, to continually developing your professional skills, and to providing the best service to your clients. The mortgage industry is ever-evolving, and staying updated with these changes ensures that you remain competitive and relevant.

Continuing Education

Continuing education is a crucial aspect of maintaining a mortgage broker license. NMLS-approved continuing education courses are required annually to ensure that brokers stay updated with the changes in the mortgage industry. These courses cover topics such as federal and state mortgage laws, broker ethics, and financial regulations.

In addition to these compulsory courses, brokers can also consider obtaining additional certifications to enhance their expertise. These certifications can provide additional information and skills in areas such as loan origination, underwriting, and compliance, demonstrating a dedication to the industry and providing a competitive advantage.

Annual License Renewal

Annual license renewal is another requirement to maintain a mortgage broker license. This involves providing evidence of ongoing education and complying with state regulations. Each year, brokers are required to renew their license, ensuring that they continue to meet the requirements of their profession.

However, the renewal process is more than just a formality. It’s an opportunity to reflect on the past year, assess your professional growth, and plan for the year ahead. It’s a commitment to continued learning, professional development, and adherence to the highest standards of the mortgage industry.

Staying Informed

In the fast-paced world of the mortgage industry, staying informed is crucial. This involves keeping track of industry trends, regulatory changes, and market developments. Staying informed ensures that brokers can provide the highest quality of service to their clients, equipped with the most recent information and offering the most accurate advice.

There are various resources available for brokers to stay informed. Subscribing to industry publications and newsletters, attending industry conferences and seminars, and networking with other mortgage brokers are all effective ways to stay updated. In an industry that is constantly evolving, staying informed is not just an option, but a necessity.

Summary

To sum up, becoming an independent mortgage broker in 2023 involves a series of steps, from obtaining the necessary education and license, establishing your business, building relationships, and marketing your services, to maintaining your license. The journey may seem long and challenging, but the rewards are undoubtedly worthwhile. With flexibility, access to multiple lenders, and high earning potential, the life of an independent mortgage broker is one of financial independence and professional fulfillment. So, are you ready to take the first step towards becoming an independent mortgage broker in 2023?

Frequently Asked Questions

What does it mean to be an independent mortgage broker?

An independent mortgage broker is an individual not employed by any specific mortgage brokering firm, allowing them to offer clients the best deal available from various lending sources.

They are able to compare different lenders and products to find the best fit for their clients. They can also provide advice on the best loan structure and repayment options.

Independent mortgage brokers are not tied to any particular lender, so they can work with an independent mortgage broker.

Do independent mortgage advisors charge?

Independent mortgage advisors are typically paid a commission from the lender, usually around 0.35% of the loan size.

In rare cases, they may charge the borrower a fee of 1-2% of the loan principal, which should be discussed before any agreement is made.

Can you make a lot of money as a mortgage broker?

Yes, you can make a lot of money as a mortgage broker with commissions ranging from $12,000 to $178,000. According to sources mortgage brokers with experience earn an average base salary of $98,162 per year.

-

Tyler Deines

★★★★★

a month ago

Our team took a leap of faith leaving the retail lending world (all we had ever known) to join IMB -- Ryan promised we would have support and systems to make the … read more transition as smooth as possible, and he has held true to that from day 1. Moving to IMB has been the best decision of my professional career -- Ryan and the team at IMB build their company right, merging the competitive rates of the broker world with the support and systems of the retail world. In the 6 months since leaving retail I have already broke my own record for highest month of loan volume, have won deals in competitive scenarios that I wouldnt have even had a shot at previously, and earned more trust and referral partners from agents and clients by offering the same great service with the most competitive rates on the market. If you are thinking of making the switch to IMB, do it. Your future you (and your future clients & partners) will thank you.

We’ll get back to you with personalized answers to your questions.